Best home equity loans for poor credit

Although maximum APRs are on the high end compared to other online lenders Upgrade makes home improvement loans available to those with poor credit history. Second the payoff terms on home equity loans are generally quite long.

Home Equity Line Of Credit Heloc Rocket Mortgage

If you miss payments the lender can foreclose on your home so these loans can be risky.

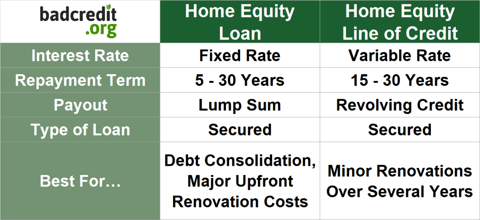

. Why Payoff is best for credit card debt. The 2017 Tax Cuts and Jobs Act allows homeowners to deduct the interest on home equity loans or lines of credit if the money is used for capital improvements such as to buy build or. Another way to leverage home equity is through a home equity line of credit or HELOC.

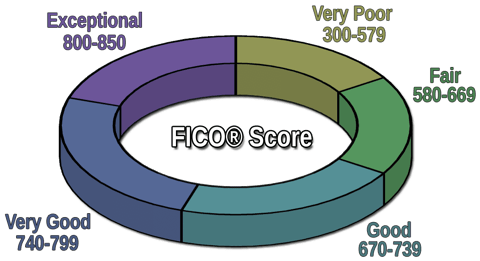

A FICO score of at least 680 is typically required to qualify for home equity loans according to Experian one of the three major credit. Citi Custom Cash Card. Although many personal loans require scores higher than this range the lenders in this list are suited for those with fair.

Home equity loans allow property owners to borrow against the debt-free value of their homes. Chase Sapphire Reserve Best Secured Card. Most lenders require a minimum credit score of 580 and a 35 down payment for an FHA loan but you could qualify with a credit score between 500 and 579 and a 10 down payment.

Bank Visa Platinum. Home Equity Line of Credit - Rates are based on a variable rate second lien revolving home equity line of credit for an owner occupied residence with an 80 loan-to-value ratio for line. If you have bad credit you may still be able to get a home equity loan since the loan is backed by.

The 14 billion Chicago-based credit union founded in 1935 is one of the. Fair credit as defined by FICO is a credit score between 580 and 669. Loans amounts which start at just.

Best Credit Cards of September 2022 Best Overall and Best Cash Back. Your credit score is one of the key factors in qualifying for a home equity loan or a home equity line of credit HELOC. Click here for more information on rates and product details.

Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. 15000 to 750000 up to 1 million for properties in California. Data provided by Icanbuy LLC.

A home equity loan is a type of loan that enables you to use the equity youve built in your home as collateral to borrow money. Unlike a home equity loan a HELOC allows you to borrow against your equity repeatedly and then pay off the balance much like a credit card. Home equity loans are often called second mortgages because you have another loan payment to make on.

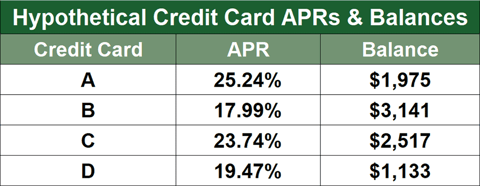

The lower the score the more likely you are to be charged a higher interest rate. Payoffs loans are exclusively for consolidating credit card debt. A home equity line of credit HELOC is a revolving credit account that is similar to a secured credit card cash advance except it is secured by your home.

Best for Small Business Owners. A home equity loan is a lump sum amount that you repay over a set number of installments. Home equity loan or line of credit.

Discover it Chrome for Students. 4 Best Uses Of Home Equity. Payments do not include amounts for taxes and insurance premiums.

Best for Balance Transfers. Amex Blue Business Cash. Like a primary loan used to buy a house your home is used as security to protect lenders if you end up defaulting on your loan.

If you need money fast Alliant Credit Union typically makes same-day online personal loans between 1000 and 50000. Upgrade is our top pick thanks to a set of features that make it easily accessible for borrowers with poor credit including a low minimum credit score requirement a 1000 minimum loan amount and. Here is how lenders classify fair and poor credit scores.

Pin On Home Loans

5 Debt Management Tips Loans For Bad Credit No Credit Loans Bad Credit

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Pre Approved Car Loans For Bad Credit Helps Bad Credit Car Buyers To Get Behind The Wheel

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Home Equity Line Of Credit Heloc Rocket Mortgage

4 Mortgage Terms To Know Before Applying For A New Home Under Mortgage Rates In Milton Mortgage Interest Rates Mortgage How To Apply

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Home Equity Loan Vs Personal Loan Which Is Better For You Home Equity Loan Personal Loans Home Equity

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

9 Best Home Equity Loans Of 2022 Money

Renovation Loans Comparison Home Renovation Loan Renovation Loans Home Improvement Loans

Discover Home Equity Loans Home Improvement Loans Home Equity Loan Home Equity

4 Subprime Home Equity Loans 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

How To Get A Home Equity Loan With Bad Credit Forbes Advisor